Circulate Capital Launches New Initiative with US$65M to Combat Plastic Pollution in Latin America and the Caribbean

May 23, 2023

IDB Lab, Builders Vision, Chevron Phillips Chemical, Danone, Dow, Mondelēz International, and Unilever Join Forces to Scale the Recycling Supply Chain Across Latin America and the Caribbean, Address Climate Change, and Improve Livelihoods

Mexico City – May 23, 2023 — Circulate Capital, a leading environmental impact investor advancing the circular economy for plastics in high-growth markets, announced today the launch of a new initiative to combat plastic pollution in Latin America and the Caribbean (LAC). IDB Lab, the innovation laboratory of the Inter-American Development Bank Group, Builders Vision, the impact platform founded by Lukas Walton, Chevron Phillips Chemical, Danone, Dow, Mondelēz International, and Unilever have joined forces to pledge a total of US$65M to help scale solutions and support best-in-class recycling businesses across the LAC region. The new LAC initiative will focus initially on Brazil, Chile, Colombia, and Mexico and soon expand across the region.

As highlighted by the United Nations, growing economies across Latin America and the Caribbean have advanced faster than their waste management and recycling infrastructures. As a result, there is an opportunity to strengthen and scale the recycling value chain across the region. This joint initiative between Circulate Capital and its partners aims to:

- Scale companies with systemic solutions that rethink recycling supply chains, from collecting and sorting to processing and manufacturing;

- Mitigate climate change and environmental risks;

- Advance the circular economy for plastic; and

- Benefit local communities and create jobs.

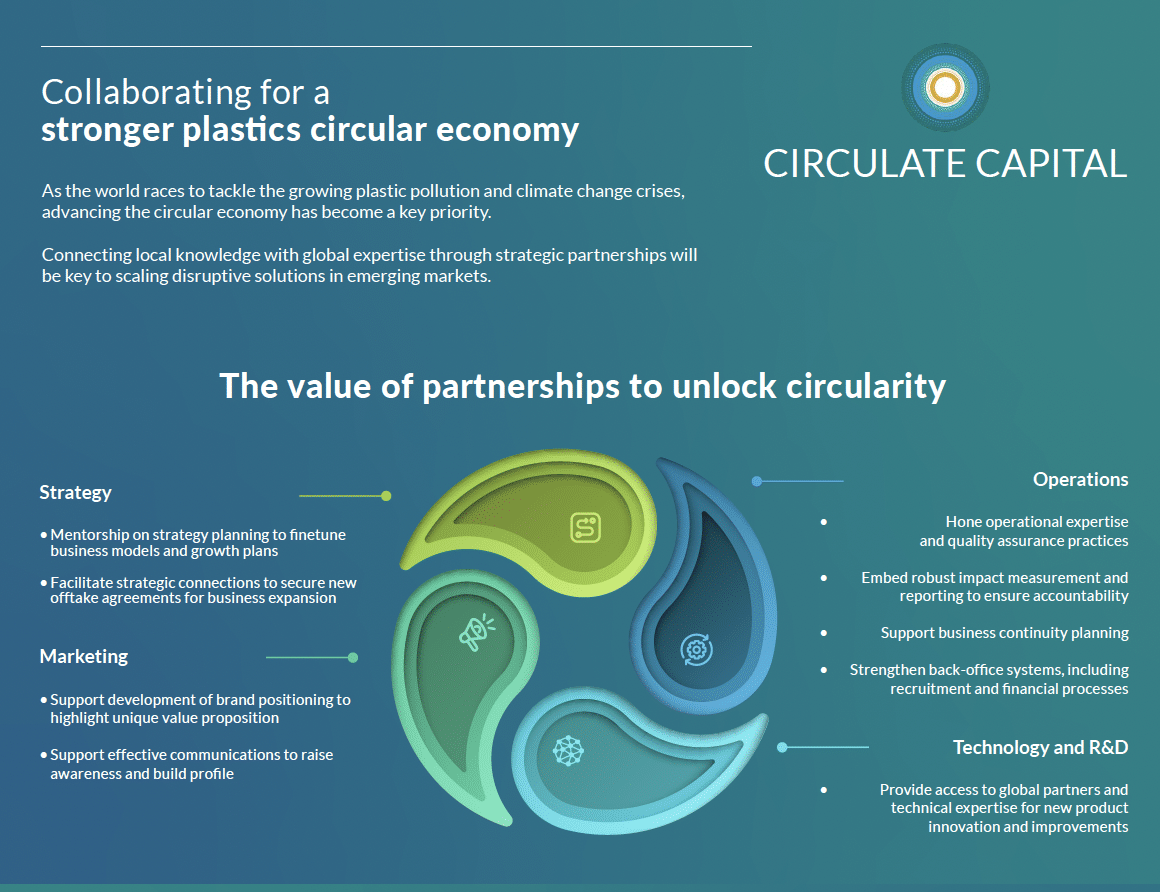

Circulate Capital’s unique model leverages the networks and expertise of IDB Lab as well as CP Chem, Danone, Dow, Mondelēz International, and Unilever, who seek new solutions to help them meet their global sustainability commitments. Beyond financing, Circulate Capital and its partners provide mentoring and technical support to recycling companies to help them reach global quality standards and gain access to global supply chains.

“We have identified promising opportunities across Latin America that, if scaled, could turn the tide on the plastic waste crisis in the region,” said Rob Kaplan, CEO and Founder, Circulate Capital. “By applying the lessons and best practices from our years of work in South and Southeast Asia, we are confident that we can support solutions in Latin America’s high-growth markets to create circularity at scale. Our corporate partners will also play a critical, strategic role in helping best-in-class recyclers to connect with global supply chains, and we look forward to their collaboration.”

The new initiative is the culmination of more than two years of research by Circulate Capital’s team and partners to understand the potential solutions in the LAC region. Circulate Capital published the findings of this research in its recent report, ‘Reducing plastic pollution in Latin America: A Handbook for Action,’ which revealed that the LAC region is primed for businesses and the private sector to transform the plastic waste value chain.

The LAC initiative will leverage Circulate Capital’s experience operating in South and Southeast Asia (SSEA), where it built the largest recycling portfolio of the region, which includes 10 companies transforming the supply chains from collection to upcycling and digitization.

“I’ve seen firsthand here on the ground in Latin America the cost of inaction to mitigate the plastic waste crisis in the region – but the problem is far from insurmountable. What’s driving our optimism for recovery and success in advancing the circular economy is that we have esteemed partners who acknowledge the critical situation and have committed to develop the local and regional solutions we need to reform our plastic waste value chain,” said Ernesto Hanhausen, Circulate Capital’s Partner for Latin America and the Caribbean. “Scaling the recycling supply chain across the LAC region will be an important way to fight climate change as well as enable the creation of safe and dignified jobs across the value chain.”

Press Releases

Press Releases

Podcasts

Podcasts  Thought Leadership

Thought Leadership

Reports

Reports

Media Coverage

Media Coverage  Infographics

Infographics